child tax credit december 2021 date

MILLIONS of Americans have already filed their 2021 federal income tax return by the April 18 deadline. Well discuss how payments were disbursed to taxpayers next.

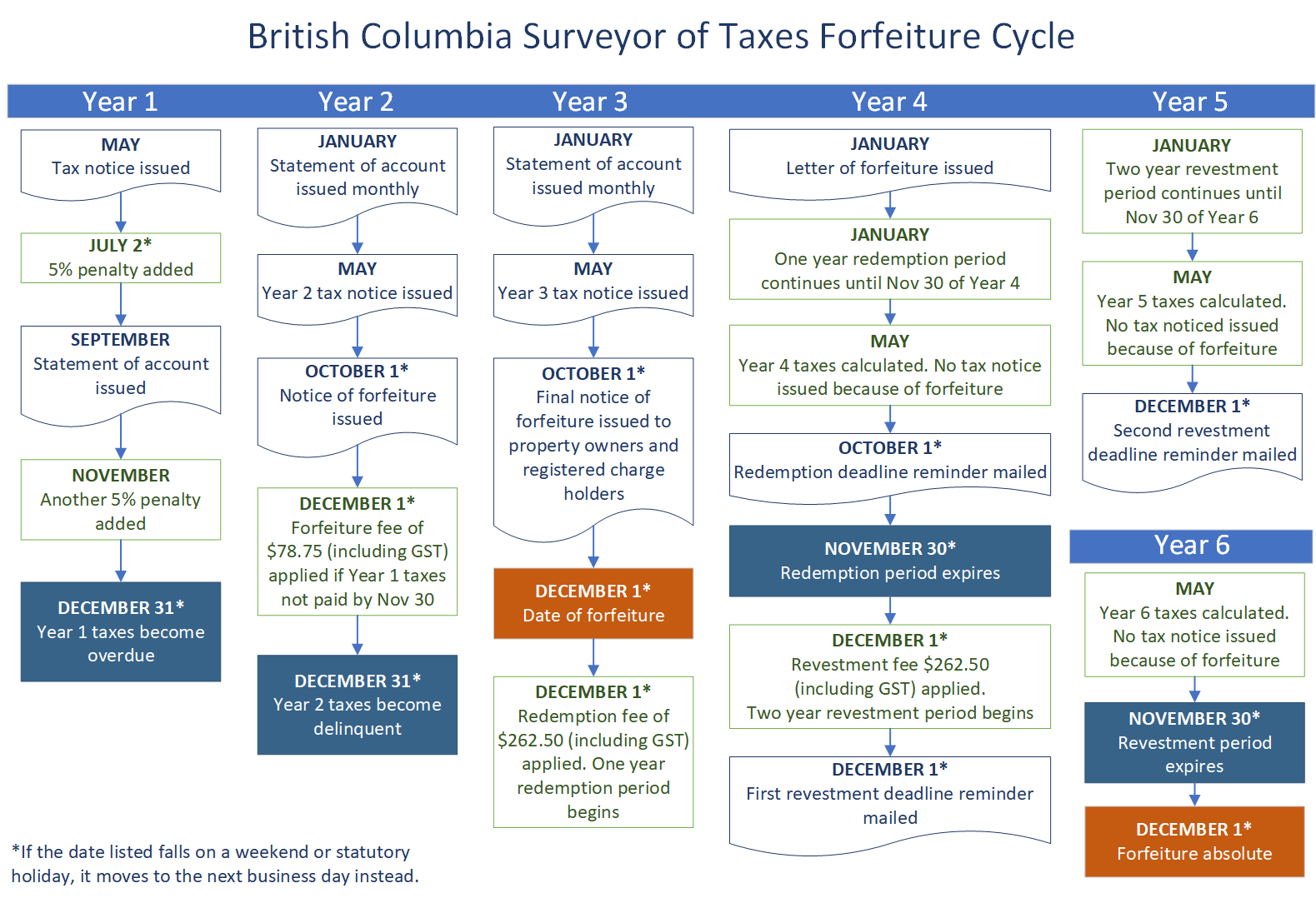

Overdue Rural Property Taxes Province Of British Columbia

Decembers child tax credit is scheduled to hit bank accounts on Dec.

. The IRS sent the sixth and final round of child tax credit payments to approximately 36 million families on December 15. No cost to see if you qualify. Time is running out to file.

Take our free 30 second eligibility quiz to learn more. IRS updates the 2021 Child Tax Credit and Advance Child Tax Credit frequently asked questions. Ad Get up to 26k per W2 employee.

Within those returns are families who qualified for child tax credits CTC. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child. The stimulus check part of President Joe Biden s child tax credit plan will see those who meet the final November 15 deadline potentially receive up to 1800 per child come. All payment dates.

Families were eligible to receive half of their 2021 child tax credit payment from July - December 2021. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000. Get the up-to-date data and facts.

FS-2022-17 March 2022. Dated toenable taxpayers to confirm the date on which any changes. Child tax credit enhancement Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis.

The CRA makes Canada child benefit CCB payments on the following dates. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon. The maximum child tax credit amount will decrease in 2022.

December Child Tax Credit Date. As part of the American Rescue Act signed into law by President Joe Biden in March the child tax credits were expanded to up to 3600 per kid from the previous 2000. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of.

The IRS bases your childs eligibility on their age on Dec. Ad Get up to 26k per W2 employee. 31 2021 so a 5-year-old turning 6 in 2021 will qualify for a maximum of 250 per month.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Heres When To Expect 1800 Stimulus Check Brendan Cole 12102021 Video shows officer open fire in shooting that killed teen girl. Time is running out to file.

October 5 2022 Havent received your payment. 13 opt out by Aug. The 2021 advance monthly child tax credit payments started automatically in July.

For both age groups the rest. IR-2021-249 December 15 2021. Take our free 30 second eligibility quiz to learn more.

For 2021 eligible parents or guardians can receive up to 3600 for each child who. Easily claim the ERTC today. The IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit to parents of children up to age five.

Wait 10 working days from the payment date to contact us. Child Tax Credit FAQs for Your 2021 Tax Return. 15 and some will be for 1800.

Many taxpayers received their second-to-last. 2021 Advance Child Tax Credit Payments start July 15 2021 Eligible families can receive advance payments of up to 300 per month for each child under age 6 and up to 250 per month for. These Child Tax Credit frequently asked questions focus on.

The American Rescue Plan Act ARPA of 2021 expanded the Child Tax Credit CTC for tax year 2021 only. Even though child tax credit payments are scheduled to arrive on certain dates you may not. Easily claim the ERTC today.

That comes out to 300 per month through the. Canada child benefit payment dates. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month.

No cost to see if you qualify. 15 opt out by Aug.

Updates On 38th Gst Council Meeting Gstr 9 Financial Information Council Meeting

Gst Tds Due Dates Jan 2019 Dating Due Date Important Dates

Find The List Of All The Important Due Dates For Gst Compliance For The Month Of April 2021 Make Sure That You File Y Indirect Tax Billing Software Due Date

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Daily Banking Awareness 13 14 And 15 October 2020 Banking Awareness Financial

Canada Child Benefit Ccb Payment Dates Application 2022

Gst Payment Dates 2022 Gst Hst Credit Guide Filing Taxes

Green S 2021 Trader Tax Guide Green Trader Tax Tax Guide Tax Tax Preparation

Canada Child Benefit Ccb Payment Dates 2022 Loans Canada

Save The Tax Dates The Turbotax Blog

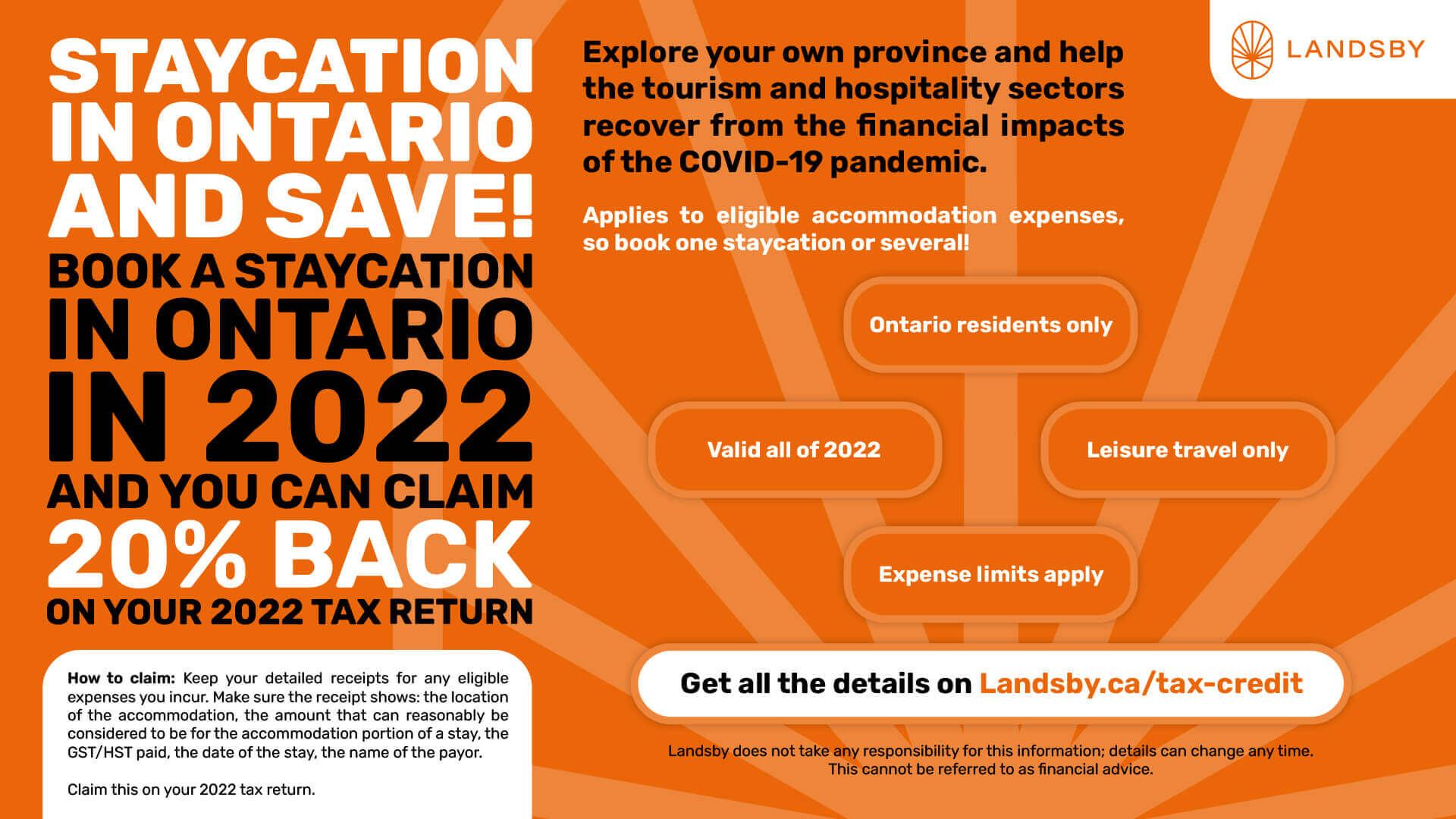

2022 Ontario Staycation Tax Credit Guide Landsby

Canadian Tax News And Covid 19 Updates Archive

Pin On Stagecoach Payroll Solutions